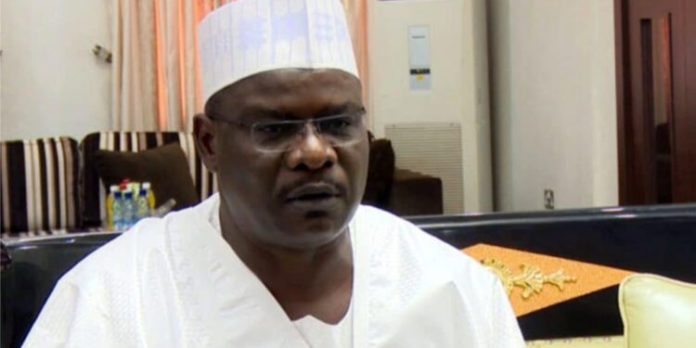

Senator Ali Ndume, representing Borno South, has voiced strong opposition to the federal government’s proposed increase in Value Added Tax (VAT), urging a reconsideration to avoid worsening the financial burden on struggling Nigerians.

The National Assembly is reportedly debating a bill to raise VAT from the current 7.5% to 10% by 2025, with plans for a further increase to 12.5% between 2026 and 2029.

Speaking on Arise Television, Ndume expressed concern that the proposed VAT hikes would disproportionately affect Nigeria’s low-income population, which is already grappling with severe economic challenges. He emphasized the daily hardships faced by millions of citizens, warning that additional taxes could push many into deeper poverty.

“We are almost losing the middle class in Nigeria,” Ndume stated. “It is either you have it or you don’t. Those that are in the middle are being squeezed out.”

He cautioned against implementing tax policies without considering the harsh realities faced by ordinary Nigerians. “If Nigerians can pay for those taxes, it is okay. But in the current situation, increasing taxes is not an alternative at all. I will not support any increase in taxes.”

The senator advised the government to focus on improving the standard of living and enabling citizens to earn a stable income before introducing new tax measures. He stressed that taxation should be fair and targeted at those who can afford it, rather than further burdening those who are already struggling.

“The north has more poverty, so if you want to increase taxes again, let’s be considerate. Tax those people who can afford it. Those who can afford the taxes in Nigeria are not even paying for them,” he argued.

Ndume also revealed plans to campaign against the proposed VAT hike, insisting that the move would impact not only the northern region but average Nigerians across the country. He urged the government to prioritize fairness in its tax policies and focus on ensuring that those who are capable of paying taxes fulfill their obligations.